TEMPORARY DISASTER-RELATED EXEMPTIONS

Individuals and businesses who suffered property damage as a result of the 2023 wildfires may be eligible for a temporary exemption.

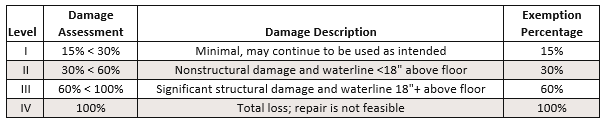

Tax Code Section 11.35 allows for a chief appraiser to determine if a property qualifies for a temporary exemption based on a damage assessment rating of Level I, II, III, or IV. The exemption applies only to qualified property, which includes improvements to real property, business personal property, and manufactured homes used as a dwelling. The amount of the exemption is determined by multiplying the property’s improvement value, after applying the assessment rating, to a fraction comprised of the days remaining in the tax year after the governor has declared a disaster divided by 365.

Damage to landscaping or trees on a property cannot be included in determining eligibility for the exemption. The temporary exemption lasts until the property is reappraised.

To apply for a temporary disaster-related exemption, property owners should complete the application form and return it to the Travis Central Appraisal District. Forms can be returned by mail (P.O. Box 149012, Austin, TX 78714-9012) or dropped off in-person at our office at 850 East Anderson Lane. Applications can also be submitted directly online.

Prefer to file by mail or office drop box? Click here to download the application form.

FREQUENTLY ASKED QUESTIONS

A homestead exemption lowers your property taxes by removing part of the value of your property from taxation. There are several different types of homestead exemption, including the general residence homestead exemption and exemptions for seniors, people and veterans with disabilities, and some surviving spouses.

No, you do not have to reapply for a homestead exemption unless the Chief Appraiser requests a new application in writing, you move to a new residence, or your qualifications for an exemption change.

Homestead exemptions do not transfer between owners. New property owners must submit a new application for a homestead exemption on their property.

To qualify for a homestead exemption, you must own and occupy the property on which you are applying. If you recently purchased a home, you may submit the form now and the homestead will be applied to the year in which you qualify.

Yes. Please include a copy of your title to the mobile home or a verified copy of your purchase contract along with your exemption form.

Can’t find the answer you’re looking for?

Check out our Frequently Asked Question library or contact us for more information.