FOR IMMEDIATE RELEASE | MARCH 4, 2021

Media Contact

Cynthia Martinez

Communications Officer

Travis Central Appraisal District

[email protected]

512-834-9317 ext. 226

PROPERTY OWNERS MAY BE ELIGIBLE FOR TEMPORARY

DISASTER-RELATED RELIEF ON THEIR PROPERTY TAXES

AUSTIN, Texas – The Travis Central Appraisal District (TCAD) wants property owners to know that they may be eligible for a temporary disaster-related exemption to help lower their property taxes if their property was damaged during the recent winter storms.

According to TCAD Chief Appraiser Marya Crigler, “Property owners who suffered damage as a result of the winter storms may be eligible for a temporary break on their 2021 property taxes.”

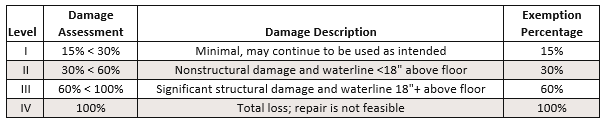

Tax Code Section 11.35 allows for a chief appraiser to determine if a property qualifies for a temporary exemption based on a damage assessment rating of Level I, II, III, or IV. In order to qualify, a property must have suffered damage that totals a minimum of 15% of the property’s improvement value. The amount of the exemption is determined by multiplying the property value, after applying the assessment rating, to a fraction comprised of the days remaining in the tax year after the governor has declared a disaster divided by 365.

The temporary exemption lasts until the property is reappraised.

Added Crigler, “Travis County property owners will spend the next few months rebuilding their homes and businesses. This temporary exemption can offer some property tax relief during this difficult time.”

The deadline to apply for a temporary exemption related to the winter storms is May 28, 2021. Property owners must complete an application and submit it to TCAD by mail, office drop box (850 East Anderson Lane), or online. More information can be found on the TCAD website at www.traviscad.org/disasters.

About the Travis Central Appraisal District

The mission of Travis Central Appraisal District, in accordance with the Texas Constitution and the laws of the state, is to provide accurate appraisal of all property in Travis County at one hundred percent market value, equally and uniformly, in a professional, ethical, economical and courteous manner, working to ensure that each taxpayer pays only their fair share of the property tax burden. For more information, please visit www.traviscad.org.

###